The Hut Group has seen its revenues grow 42% to £1.6bn, with profits up 35%.

In its preliminary results and first quarter trading statement, it stated that its Ingenuity Commerce operation had seen a 188% sales growth over the first part of 2021.

“We approach FY21 with confidence having navigated successfully through a milestone year in the Group’s history. I am particularly proud of how our people have responded to the changing environment, displaying determination to make a difference across all aspects of our operations from new product development, to digital marketing, M&A, fulfilment and THG (eco),” stated CEO, Matthew Moulding.

“Our global D2C brand building capabilities and proprietary Ingenuity technology platform has enabled us to further develop both our external brand relationships, and our expanding portfolio of Beauty and Nutrition own brands. Leveraging the platform to build an impressive client base of blue-chip consumer brands has been a highlight of the year, supported by encouraging momentum in the current year Ingenuity Commerce pipeline.”

The company floated on the stock exchange in September 2020, with Moulding stating that he “would not seek to profit from his employment at THG.” He says that he has waived his salary, with the Group making a charitable donation of a similar value (£187k). He has also announced plans to donate £100m of THG PLC shares to charity through The Moulding Foundation.

“Management’s purpose for the IPO was to step change THG’s access to funding in order to capitalise on Covid-19 accelerated market changes. As we progressed through 2020, those changes became more apparent in terms of the volume and scale of opportunities available to the Group, as evidenced by the c. £400m committed to acquisitions since IPO, most notably the acquisition of Dermstore in the US,” he continued.

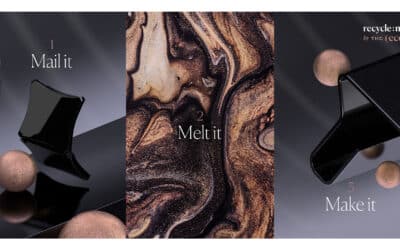

“After highlighting our commitment to reducing the environmental impact of Group operations with the launch of THG (eco) in 2020, we have announced significant investment to support the Group’s strategy to off-set existing usage and footprint. Plastics are a real and immediate problem for THG’s operational sites, our consumers, and for Ingenuity partners. We are investing in best-in-class plastic recycling operations that at first help us off-set our plastic footprint, but in time enable us to close the loop and re-use the plastic we process within THG directly.

“We have delivered exceptionally well on our commitments at IPO and we move forward with purpose, to advance our strategy with investment in talent, infrastructure, THG (eco) and targeted M&A, and to continue to deliver growth on a global scale.”

The group will shortly be opening its new ICON building near its Manchester Head Office. The content studio, which will be Europe’s largest, will house 2000 people.