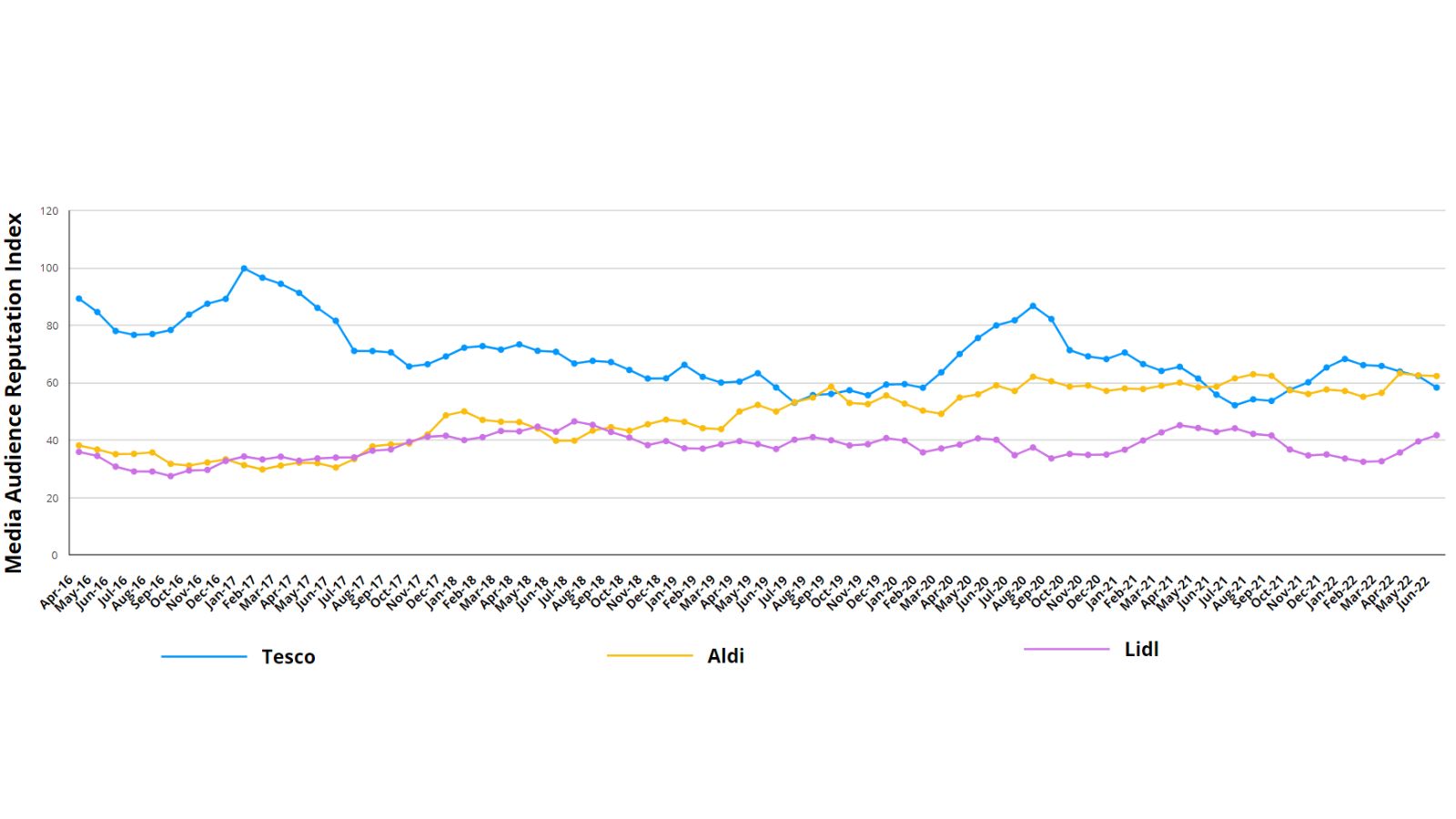

With the on-going cost of living crisis, supermarkets now need to pay more attention to online media coverage as the battle for consumers’ hearts and minds around cheap prices intensifies, explains Mark Westaby, Director at Metricomm. Here he uses data from Metricomm’s Media Audience Reputation Index (MARI) to delve into the impact of online media coverage on performance.

For those too young to remember, ‘Anything You Can Do, I Can Do Better’ was a famous song during the time when grocery stores were run by middle-aged men wearing brown warehouse coats; and while the original lyrics might have come from the Broadway musical, Annie Get Your Gun, they could just as easily be applied to today’s UK retail grocery market as the cost-of-living crisis bites deep and hard.

Given the pledges made by the biggest UK supermarkets to price-match the discounters you might be forgiven for thinking they would be the ones belting out the old musical showstopper, but in fact you would be wrong.

Supermarket price wars

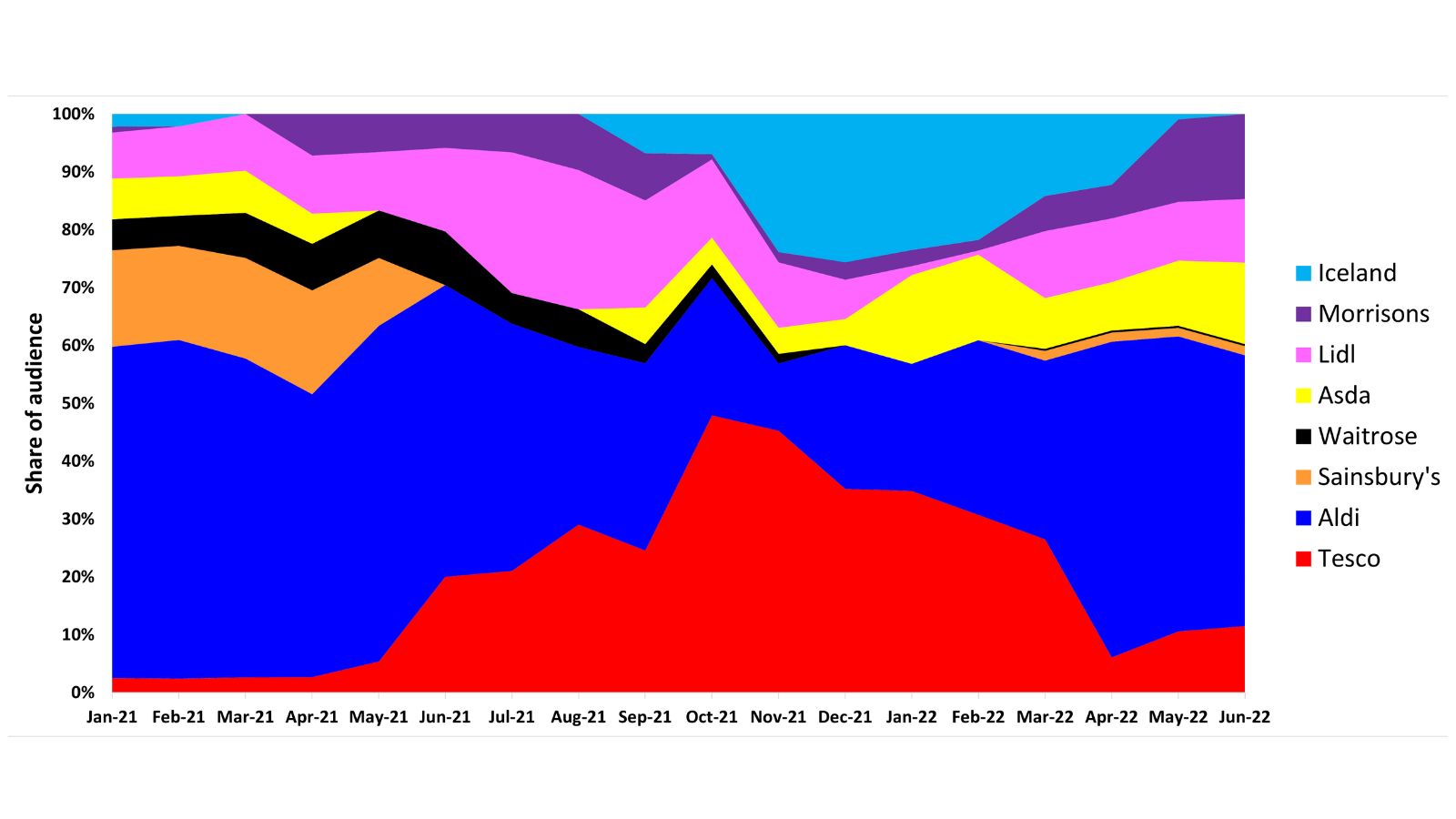

Any price comparison obviously depends on the products chosen for the basket, but there is plenty of evidence that the original discounters, Aldi and Lidl, are once again winning the price war.

Indeed, there is every likelihood that Aldi will overtake Morrisons to become the UK’s fourth largest supermarket over the next 12 months while Lidl continues to maintain its impressive share as others stumble around them. But given the huge amounts thrown at advertising by the UK’s biggest supermarkets to beat the discounters, how is it that Aldi and Lidl are able to maintain such impressive market share?

One explanation, which is very likely to surprise a lot of people, will have played a much bigger part in Aldi and Lidl’s success than is likely to be appreciated by the marketing and advertising industries. If ‘Anything You Can Do, I Can Do Better’ goes back a long way, so too does the prevailing view among many advertising and marketing professionals that media coverage plays a relatively minor role in the marketing mix. That might have been the case when the country’s news was delivered to doorsteps entirely in printed form, but things have changed dramatically since then.

Going back to the musical theatre, it is an interesting fact that when movies were first introduced the producers simply filmed what they were used to seeing on stage without realising or appreciating the power of the new medium.

A remarkably similar thing is happening with the shift from print to online media, with a surprising number of advertising, marketing and, believe it or not, PR people unable to believe that anything not appearing in print counts as ‘proper’ media coverage. Nothing could be further from the truth, with indisputable evidence now available that online media coverage is proving to be an extremely powerful driver of consumer behaviour from consideration through to sales.